Example

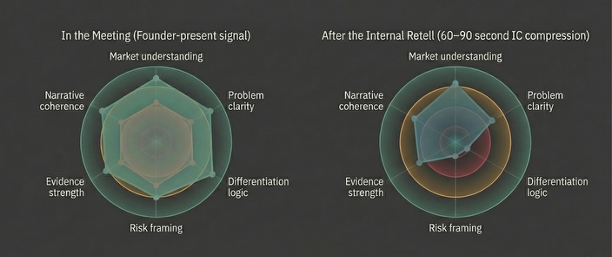

One fundraising story — before and after IC compression

A single snapshot. No theory. What the founder thought landed vs what circulated after the internal retell — mapped to the same deliverables.

This is the phase that determines which funds are likely to say yes, which are likely to say no, and whether a decision can still be changed.

1. Founder-Present read (full context).

“€35k–€120k ACV, ops + finance sign-off. We’re replacing manual workflows that break at 200+ headcount.”

“We’re displacing spreadsheets + 3 point tools. The switch happens because approvals and audit trails are failing.”

“We win on depth. X is horizontal. Y is services-heavy. We ship in weeks, not quarters.”

“ARR €4.1m. 118% NRR. Gross margin 82%. CAC payback ~11 months. 6 logos >€100k.”

“Execution risk is contained. Pipeline coverage is 3.2× next quarter target. We’ve hired this team before.”

“Wedge in approvals → expand into compliance + reporting → become the system of record.”

2. Investor internal retell (compressed)

“Ops tooling space. They know the segment but it’s saturated. A bunch of adjacent products already.”

“Not sure it’s painful enough to force switching—feels like ‘nice to have’ in some segments.”

“Hard to say why they win long-term vs incumbents. Feels like execution needs to be perfect.”

“Good numbers, still early. Need to see if this holds when they scale sales.”

“Execution-heavy under competition. Burn could creep if sales efficiency dips.”

“Good company. Unclear if this becomes a must-win category leader.”

3. What this turns into (deliverables)

Internal retell (decision-level)

“Strong metrics, but execution risk dominates in a crowded market.”

Dominant signal

Execution risk under competitive comparison.

This one leg pulled differentiation inward, dragged evidence downward, and fractured narrative coherence in the internal retell.

Signals that bent (but survived)

- ARR growth → “good, but not yet proven at scaled GTM”

- NRR 118% → “early cohorts; unclear if it holds with broader segment mix”

- ‘We win on depth’ → “hard to verify vs incumbents without a structural constraint”

Signals that dropped out

- “Ship in weeks” (never repeated after the meeting)

- Customer quotes (did not survive compression)

- Founder track record (mentioned once, then disappeared)

Priority moves

- Anchor growth to one non-headcount-dependent lever.

- Reframe competition around a constraint incumbents can’t follow.

- Remove one initiative that reinforces “execution-heavy”.

What the next internal retell sounded like

“Much clearer what actually has to go right.”

“Feels more bounded.”

“Less to debate.”

The internal read stabilized earlier — before comparison amplified distortions.

Run a 2-min Intake

No materials required to start. Private.